The Swiss real estate market saw significant shifts in 2023, driven by a blend of economic factors and evolving investor strategies. Notably, Pilet & Renaud Transactions, a prestigious name in the Swiss real estate sector, observed a pronounced uptick in property and investment transactions towards the latter half of the year. Why was this the case? Pilet & Renaud Transactions delves into the reasons behind this trend, the nature of the investments, and the distinctive opportunities within the Geneva region, as documented by industry experts and supported by robust data…

Economic Attractiveness and Market Dynamics

Switzerland’s reputation for economic stability has long made it a magnet for investment. In 2023, this characteristic was once again a cornerstone for attracting investors, especially in a year marked by fluctuating mortgage rates and property prices. The beginning of the year saw an increase in mortgage rates, leading to a significant decrease in commercial and residential property prices. Pierre Hagmann, delegated administrator at Pilet & Renaud Transactions, explains, “Investors initially adopted a ‘wait and see’ approach in response to the hike in mortgage rates.”

As the year progressed, the mortgage rates stabilized from September onwards, but property prices remained relatively lower than usual. This scenario set the stage for a resurgence in transactions. Private investors, typically focusing on properties valued below CHF 10 million, found renewed confidence. In contrast, institutional investors, such as insurance companies and pension funds, began actively investing in properties valued above the CHF 10 million mark. Land Register publications from this period highlighted significant transactions, including the sale of a portfolio of several buildings for CHF 178 million.

Pilet & Renaud Transactions’ data revealed that approximately 33% of property transactions occurred between January and June, while a substantial 67% occurred between July and December in Geneva. These figures underscore a significant shift in investment patterns as the year unfolded.

Diverse Investment Opportunities in the Lake Geneva Region

The Lake Geneva region continues to be a hub for diverse investment opportunities. For Swiss nationals, the market offers residential, commercial, and mixed-use buildings. The ongoing housing crisis, characterized by a demand far exceeding supply, makes residential investments particularly attractive. Non-Swiss residents, however, are limited to commercial properties. At the end of 2022, OCSTAT reported a 3.9% vacancy rate in Geneva’s Business District, which is expected to rise due to the decentralization of banks and large institutions.

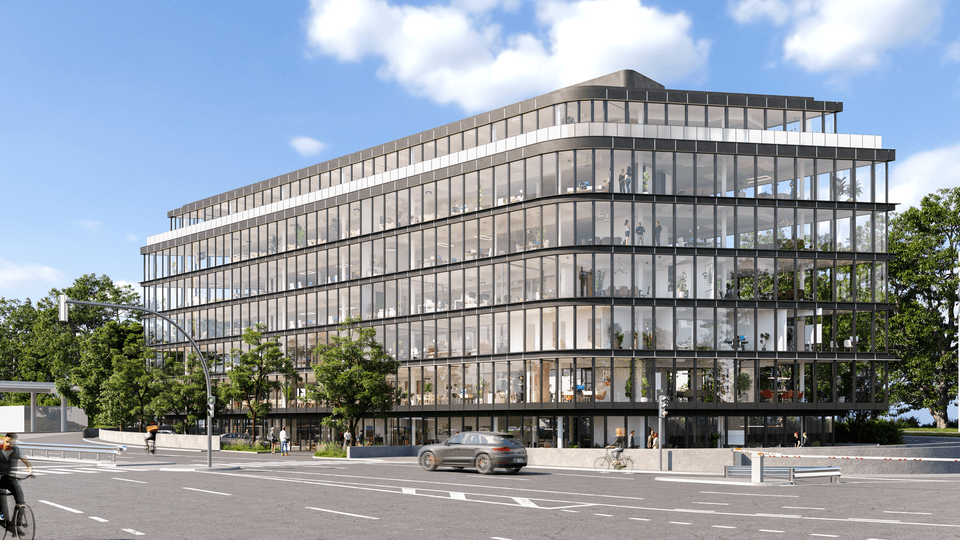

Looking ahead, the transformation of the “Quartier des Banques” from commercial to residential space over the next 20 years is poised to redefine investment landscapes. Moreover, the area near Geneva Airport exhibited new vitality, with significant transactions signalling burgeoning opportunities in construction and logistics. Pilet & Renaud Transactions’ broad portfolio encompasses residential, commercial, and new development properties. One of the spotlight developments is “The 41”, which exemplifies the type of innovative commercial spaces available.

The year 2023 was pivotal for real estate investments in Geneva, with economic stability and strategic market conditions fostering a robust investment environment. Pilet & Renaud Transactions, with its deep understanding of market dynamics and a diverse portfolio, continues to serve as a key player for both seasoned and new investors. For those looking to explore investment opportunities, Pierre Hagmann and his team are ready to leverage their extensive network to meet specific investment needs.

To find out more about Pilet & Renaud Transactions SA, visit the links below:

Pilet & Renaud Transactions SA

Bd Georges-Favon 2

1204 Geneva

Switzerland

Web: pilet-renaud.ch

Tel: +41 22 322 92 22

Email: info@pilet-renaud.ch

Instagram: @piletrenaud

Facebook: @piletrenaudsa